tax unemployment refund date

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. If you are eligible you will automatically receive a payment.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

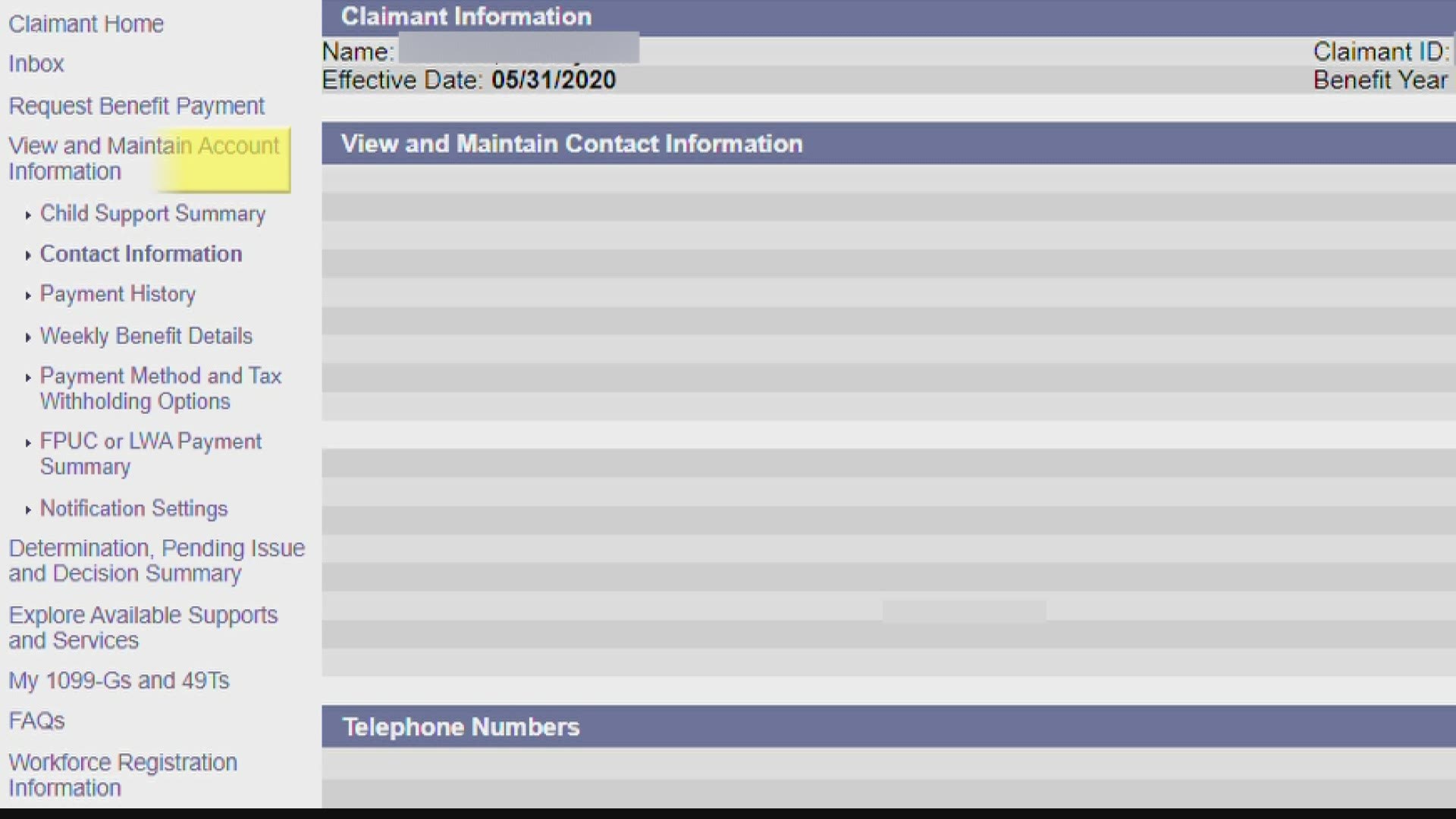

View unemployment tax account information for example statement of account chargeback details tax rates quarterly wage reports payment history and the tax account.

. Ad See How Long It Could Take Your 2021 Tax Refund. Check For The Latest Updates And Resources Throughout The Tax Season. IR-2021-151 July 13 2021.

File Wage Reports Pay Your Unemployment Taxes Online. If you choose to protest the rate notice you must file a protest with the Florida Department of Revenue within. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million. The unemployment tax refund is only for those filing individually. Annual Reemployment Tax Rate Notices Form RT-20 are mailed in mid-December.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. When to expect your unemployment refund.

I checked the get my payment tool on the IRS website yesterday and it finally updated and was able to give me information for the first time ever and they are stating that my stimulus will be. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. PdfFiller allows users to Edit Sign Fill Share all type of documents online.

Ad Register and Subscribe Now to work on Amended Maryland Tax Return more fillable forms. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. Refunds are expected to begin in May. This is the fourth round of refunds related to the unemployment compensation.

Learn How Long It Could Take Your 2021 Tax Refund. Depending on whether you fall into the first or second wave these payments will continue into. The Middle Class Tax Refund MCTR is a one-time payment to provide relief to Californians.

Tax Refund Status Is Still Being Processed

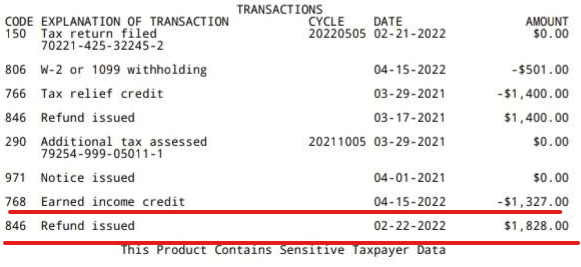

Code 846 Refund Issued On Your Irs Tax Transcript What It Means For Your Direct Deposit Payment Date And Reversal Codes 841 898 Aving To Invest

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

How To Claim Unemployment Benefits H R Block

Tax Refund Timeline Here S When To Expect Yours

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

I Got Unemployment In Florida How Will My Taxes Be Affected Firstcoastnews Com

Tax Refund Offset Tax Topic 203

Tax Refund Stimulus Help Facebook

Time Running Out For Ohioans Claiming 2017 Tax Refund

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Irs Has 1 3 Billion In Refunds For People Who Haven T Filed A 2017 Return The Washington Post

Unemployment Tax Refund Taxpayers Frustrated By Irs Unresponsiveness

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Unemployment 10 200 Tax Break Some States Require Amended Returns

Tax Refunds On Unemployment Benefits Still Delayed For Thousands